What Community Banking Does (And Doesn’t) Look Like

What Community Banking Does (And Doesn’t) Look Like

True community banks are hard to fake. Here are some characteristics that make the authentic ones easy to spot.

Many customers opt to bank with community banks for a better sense of connection. They’re interested in a level of support national banks and out-of-town banks can’t quite deliver because it requires more than just putting a name on a branch in a specific area — it requires local roots. And that’s just the start.

True community banking requires a shared commitment to and appreciation for a place and the people in it; an understanding of their unique financial needs, and providing solutions that actually work in the context of their lives. It requires investing in, giving back to, and really getting to know a community and the people in it.

While plenty of banks claim to be community banks, far fewer back it up with their actions. If you’re wondering what real community banking looks like in practice, look out for these traits:

Does look like: A strong local presence

Community banks like Wintrust function as assets to their communities because they are designed to work alongside the community from within it, not from afar.

A strong local presence is an advantage for customers in pursuit of their short- and long-term financial goals because it lifts the whole community up. Community banks are the ones seeking out every opportunity to establish a local connection — for them, no connection point is too small.

When seeking out a community bank, look for the institutions hosting financial education courses, sponsoring and participating in community events, volunteering for local awareness initiatives and causes, and even throwing neighborhood cookouts.

Does not look like: Poor customer service

If you’re used to a community bank with a local connection and personalized service, you are unfortunately unlikely to receive the same service from a big bank or out-of-town bank stepping into the picture.

Too often when local banks are bought, customer service suffers because customers themselves become an afterthought. It’s no easy feat for organizations to combine operations while still maintaining day-to-day responsibilities, but customer service should be just as important as aligning products and services with corporate and shareholder interests.

When banks aren’t going above and beyond to help their customers in times of change or need, personalized service is no longer something they can claim or you can rely on. At true community banks, being passed around a call center or left to fend for yourself on a FAQ page doesn’t pass for customer service. Community banks provide support and deliver solutions you can count on every step of the way.

Does look like: Demonstrated community investment and engagement

Banks play an important role in a community’s economic growth through education, investment, services, and support. One of the hallmark benefits of community banking is sustained economic development, because banking locally allows your money to be reinvested into area businesses and nonprofits, which strengthens the local economy and helps neighborhoods grow.

True community banks invest in thoughtful initiatives and partnerships that strengthen local businesses. Oftentimes, this comes in the form of consistent financial contributions to community organizations and nonprofit partners, but also through ongoing educational programming that fosters long-term success.

At Wintrust, we believe in supporting our communities by sitting on local boards, volunteering with local organizations, and sponsoring local events, among many other activities. Because a healthy economy supports a financially healthy community.

Does not look like: Transactional relationships

Banking and financial planning are inherently personal and the relationships central to community banking reflect this. If your banking relationship indicates anything less, it’s a sign you’re less valuable than your wallet to your bank. Despite what the marketing materials you receive from your bank may say, your bank’s actions will be what tells you whether it knows you and your community to the degree it should.

Having a banking partner that values relationships, understands your needs and goals, and works to secure your success is one of the biggest advantages you can have in your journey to financial stability and success. When your bankers grew up, live, and work where you do, you are more likely to experience reliable, dependable service, but also form a stronger relationship with them, which results in more personalized guidance.

Does look like: Expertise in the local business landscape

Your bankers shouldn’t just know you, but your community, too. Community banking requires a level of market insights and local expertise that outsiders coming in and overhauling once-local banks are simply incapable of delivering to properly serve an area’s unique needs.

A demonstrated understanding of a community’s banking and business landscape is essential to effective customer service and solutions planning. This becomes doubly important for local business owners. Whether your business is emerging or established, universal or specialized, local market expertise is a prerequisite for your banking partner to aptly provide support and solutions in line with your specific business goals.

Community banks recognize how unique and competitive services and solutions need to be in order to generate success and ongoing value in your area because they’re local businesses, too. That’s why they are best equipped with the tools to help your business thrive within the nuances of your business community and local economy.

Does not look like: Cookie-cutter services and solutions

On top of poor customer service and transactional relationships, cookie-cutter banking services and solutions can raise doubt about how community-focused a bank actually is and can leave you questioning whether it really has your back.

If you’re looking for a sign your bank is taking a canned approach to customer service and overall operations, pay attention to how often you receive inconsistent information online, over the phone, or from different people over the course of an in-person interaction. Other oversights like debit cards being declined, inaccessible online accounts, and lax overdraft safeguards (and hefty fees that follow) are all indicative of the kind of customer attention you’ll experience without the kind of dedicated account management available at community banks.

Or perhaps you experienced a rocky transition to a new product or service and there was no accountability from your bank for the resulting inconvenience — this behavior turns customers from people into account numbers from which business should be maximized.

Our commitment to community

As a company made in this area, for this area, Wintrust and its family of true community banks is dedicated to the unique neighborhoods each serves. When you bank with us, you can be confident your money is going back into the things that matter most to you.

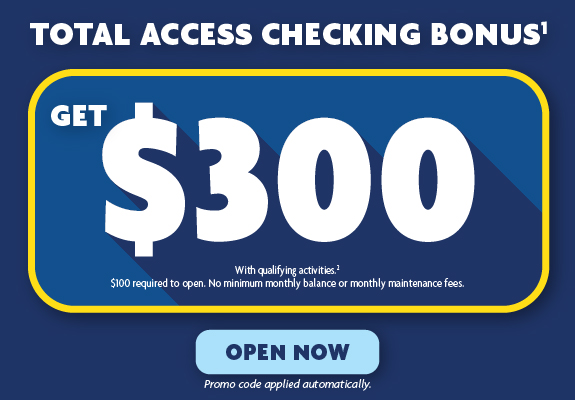

Give community banking a try with this offer:

1. Total Access Checking Bonus Information. Offer valid for accounts opened 2/1/2024 — 1/29/2025. Offer not available to existing or closed checking account customers of WTFC & its subsidiaries or employees. Limit 1 bonus payment per customer, regardless of number of accounts opened; may only be received from 1 WTFC location. Offer combinable with any WTFC savings offer. Bonus payment subject to IRS 1099-INT reporting & may be considered income for tax purposes.

2. Total Access Checking Bonus Qualifications. (i) Open new Total Access Checking account; (ii) mention offer during in-branch account opening, visit URL provided, or enter Echecking300 when applying online; (iii) have direct deposits totaling at least $500 per month made to the new account for 2 consecutive calendar months after the calendar month the new account was opened (‘Qualification Period’); & (iv) enroll in online banking & e-statements within the Qualification Period. Direct deposit is a payment made by a government agency, employer, or other third-party organization via electronic deposit, but does not include teller/ATM/mobile or remote deposits, wire transfers, digital banking/telephone transfers between accounts at WTFC, external transfers from accounts at other financial institutions, peer-to-peer network payments like Zelle or Venmo, or debit card transfers & deposits. New account must be open & have a balance greater than $0 to receive bonus payment. Balance determined as of end of each business day as funds currently in the account including deposits & withdrawals made in the business day. For eligible customers, bonus is deposited into the new account within 30 calendar days after the Qualification Period. A listing of WTFC locations can be found here: www.wintrust.com/locations.