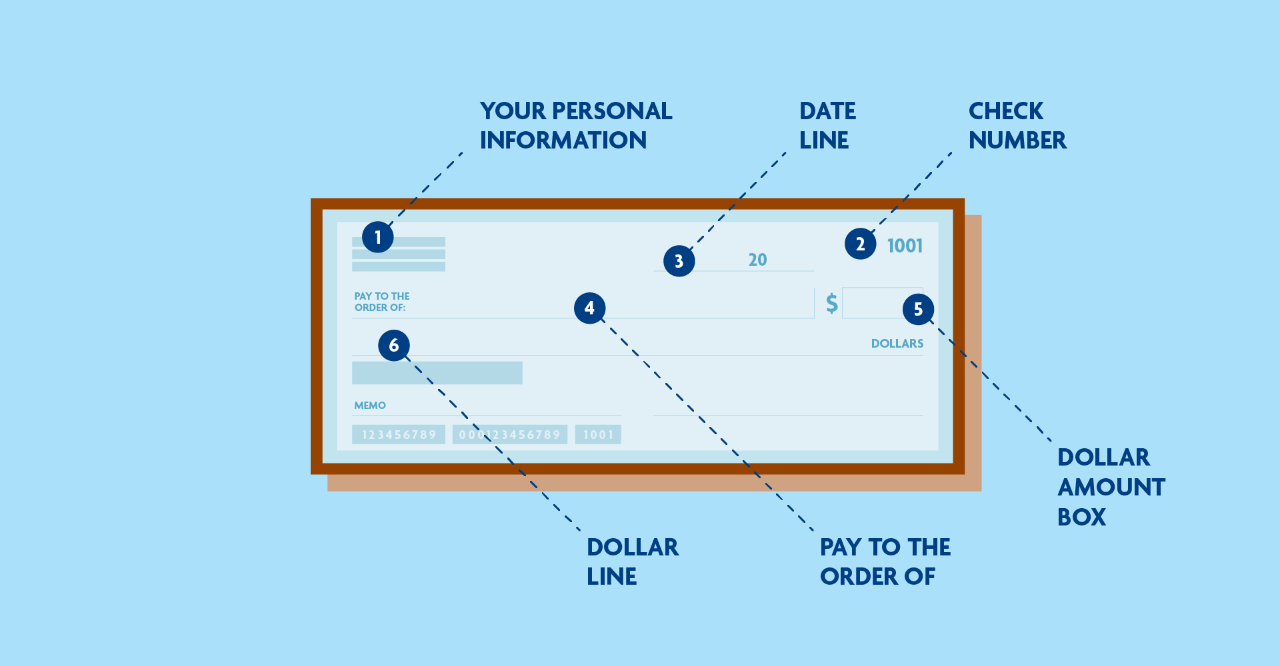

1: Your personal information

In the upper left corner of your check, you’ll find the name and address you’ve registered with your bank.

2: Check number

In the upper and lower right corners of your check is the check number. This number is for your own record-keeping and provides additional account security. Check numbers help you keep track of which checks you have used and will appear as line items in your bank statement.

3: Date line

When writing a check, here is where you record the date that you intend for the transaction to occur. If you write a check and plan for it to be deposited at a later date, make sure that your account has adequate funds to cover the amount because your check’s recipient may not wait until the date written to deposit the check.

4: “Pay to the order of” line

This line is where you write the name of the business or individual your check is intended for.

5 and 6: Dollar amount box and dollar line

To the right of the “Pay to the order of” line, your check has a box with a dollar sign in front of it. This is where you write the total amount of money you wish to send in numerals; for example, $315.10.

On the line directly below, you will write out the check amount long-form, with words instead of numbers. If your check amount includes cents, they should be written as a fraction. Using the example above, this would be: Three hundred and fifteen dollars + 10/100.