Wintrust Asset Finance Ranked #31 in 2025 Monitor 100

Data tokens on this page

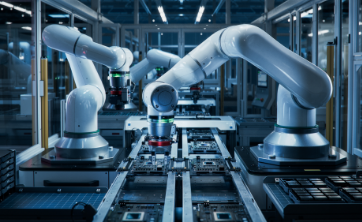

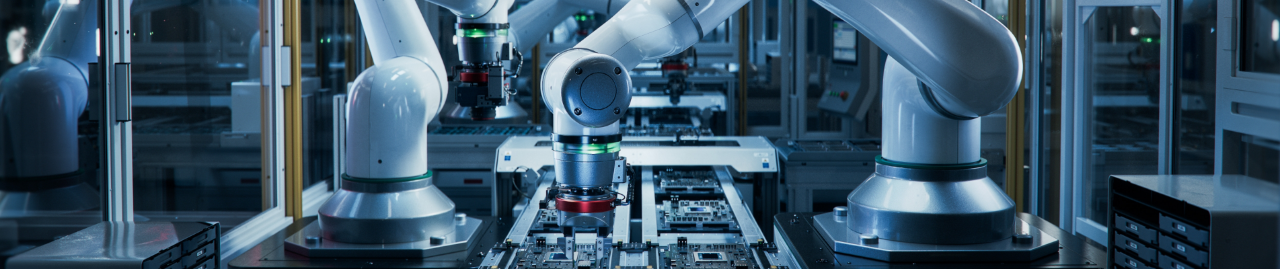

Equipment Loans and Leasing

Equipment Loans and Leasing

CUSTOMIZED LEASING SOLUTIONS

If your company is looking for a sophisticated lease solution to help support an acquisition, expansion, or to help you run day-to-day operation, our team can help. When it comes to equipment finance and leasing, we have three specialized, collaborative teams. That ensures that whatever you or your clients' particular needs, we're prepared to work together to best serve you.

NATIONWIDE EQUIPMENT FINANCING SOLUTIONS

We work with companies nationwide to provide equipment financing solutions and offer typical transaction sizes between $5 million and $50 million.

PROGRAMMATIC SOLUTIONS FOR VENDORS & EQUIPMENT LESSORS

Our team offers programmatic finance solutions for vendors and lessors with: app-only products up to $500,000; UNL and recourse solutions for single source funding and single transaction as well as portfolio purchases typically from $500,000 to $50 million.

EQUIPMENT FINANCING FOR CHICAGOLAND, INDIANA, & WISCONSIN

Our team provides equipment financing solutions for companies in Illinois, Indiana, and Wisconsin with typical transaction sizes of $500,000 to $10 million.

FUNDING FOR INDEPENDENT EQUIPMENT LEASING COMPANIES

Our team provides financing for equipment leasing companies nationwide through non-recourse debt discounting, recourse lines of credit, and equity lines of credit.

AWARDS & ACCOLADES

Wintrust Asset Finance is proud to announce it was recently listed in Monitor Daily’s Monitor 100 for 2025. The Monitor 100 provides a total dimensioning of the largest equipment finance and leasing companies in the U.S. The ranking exemplifies WAF’s commitment to providing sophisticated loan and leasing products to equipment-focused commercial companies throughout the country.

Wintrust Asset Finance Ranked #31 in 2025 Monitor 100

Wintrust Asset Finance is proud to announce it was recently listed in Monitor Daily’s Monitor 100 for 2025. The Monitor 100 provides a total dimensioning of the largest equipment finance and leasing companies in the U.S. The ranking exemplifies WAF’s commitment to providing sophisticated loan and leasing products to equipment-focused commercial companies throughout the country.

Wintrust Commercial Finance Celebrates 10th Anniversary

On April 15, 2025, Wintrust Commercial Finance (WCF) celebrated 10 years of service providing loan and lease options to clients seeking equipment financing to support their business objectives.

Chelsea Wood Thurn: A Trailblazer in Equipment Finance and Leadership

A former speech pathology and behavioral therapy professional, Chelsea embraced a career pivot in 2013, diving into equipment finance with determination. In 2018, she was one of four founding members of Wintrust Specialty Finance (WSF), building the company from the ground up. Now as Vice President and Funding Manager at Wintrust Specialty Finance, she has become a standout leader recognized as one of the 2024 Monitor Top Women in Equipment Finance.

Chelsea Wood Thurn: A Trailblazer in Equipment Finance and Leadership

A former speech pathology and behavioral therapy professional, Chelsea embraced a career pivot in 2013, diving into equipment finance with determination. In 2018, she was one of four founding members of Wintrust Specialty Finance (WSF), building the company from the ground up. Now as Vice President and Funding Manager at Wintrust Specialty Finance, she has become a standout leader recognized as one of the 2024 Monitor Top Women in Equipment Finance.

David Normandin Named Chair of Equipment Leasing and Finance Foundation Research Committee

CEO of Wintrust Specialty Finance, David Normandin, was named Chair of the Equipment Leasing and Finance Foundation’s Research Committee for 2025. The Foundation embraces the tagline Your Eye on the Future. Everything they do is inspired by innovative thinking to advance the $1 trillion equipment finance industry for years to come.

David Normandin Named Chair of Equipment Leasing and Finance Foundation Research Committee

CEO of Wintrust Specialty Finance, David Normandin, was named Chair of the Equipment Leasing and Finance Foundation’s Research Committee for 2025. The Foundation embraces the tagline Your Eye on the Future. Everything they do is inspired by innovative thinking to advance the $1 trillion equipment finance industry for years to come.

WINTRUST ASSET FINANCE RANKED #19 IN THE 2024 MONITOR BANK 50

Wintrust Asset Finance Inc. (WAF) was listed in the MonitorDaily’s 2024 Monitor Bank 50, for the ninth year in a row, at number 19, with assets totaling more than $3.71 billion and a business volume of $1.4 billion.

DAVID NORMANDIN NAMED A MONITOR CURRENT LEADER ICON FOR 2024

David Normandin, CEO of Wintrust Specialty Finance, was named a Monitor Current Leader Icon for 2024. Featured in a recent interview with the MonitorDaily, he shares his thoughts with the publication, offering a glimpse into his approach to leadership and company culture. Normandin focuses on building a team-driven environment where people feel empowered to succeed — not just for the organization, but in their personal lives.

David Normandin Named a Monitor Current Leader Icon for 2024

David Normandin, CEO of Wintrust Specialty Finance, was named a Monitor Current Leader Icon for 2024. Featured in a recent interview with the MonitorDaily, he shares his thoughts with the publication, offering a glimpse into his approach to leadership and company culture. Normandin focuses on building a team-driven environment where people feel empowered to succeed — not just for the organization, but in their personal lives.

WINTRUST ASSET FINANCE RANKED #21 IN THE 2023 MONITOR BANK 50

Wintrust Asset Finance Inc. (WAF) was listed in the 2023 Monitor Daily’s Monitor Bank 50 at number 21 for the second year in a row, demonstrating their ongoing commitment to providing sophisticated loan and leasing products for equipment-focused commercial companies nationwide.

WINTRUST ASSET FINANCE RANKED #21 IN THE 2023 MONITOR BANK 50

Wintrust Asset Finance Inc. (WAF) was listed in the 2023 Monitor Daily’s Monitor Bank 50 at number 21 for the second year in a row, demonstrating their ongoing commitment to providing sophisticated loan and leasing products for equipment-focused commercial companies nationwide.

WINTRUST ASSET FINANCE RANKED #34 IN THE 2024 MONITOR 100

It takes true teamwork to consistently deliver the solutions and unparalleled customer service our clients deserve, and all of our WAF teams have done an outstanding job.

MEET OUR TEAM

Wintrust Asset Finance is a subsidiary of Beverly Bank & Trust Company, N.A. Wintrust Commercial Finance and Wintrust Equipment Finance are divisions of Wintrust Asset Finance Inc. Wintrust Specialty Finance is a division of Beverly Bank & Trust Company, N.A., a Wintrust Community Bank. Banking products provided by Wintrust Financial Corp. banks.