Data tokens on this page

Get your game day essential

Get your game day essential

GIVEAWAYS

Be the first to know about exclusive swag, ticket sweepstakes, and more.

FREE CUSTOMER EVENTS

Join us for game day cookouts, networking nights, and more.

No minimum monthly balance, no monthly maintenance fees, and only $100 to open. Promo code applied automatically.

No minimum monthly balance, no monthly maintenance fees, and only $100 to open. Promo code applied automatically.

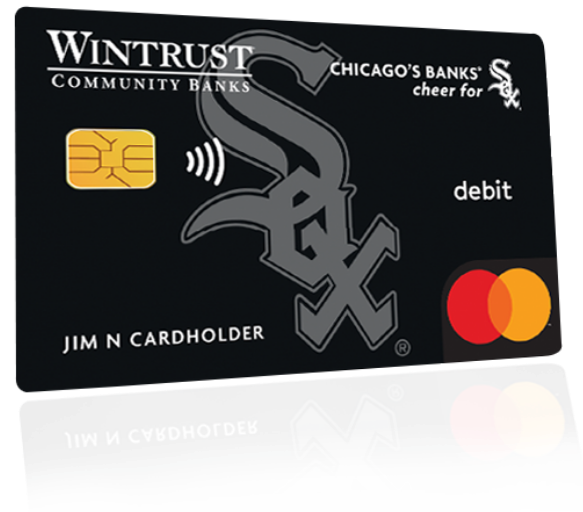

BIG WHITE SOX FAN? SCORE EVEN BIGGER PERKS!

An exclusive White Sox debit card is just one way you win, no matter the score.

Only $100 to open. No minimum monthly balance or monthly maintenance fees.

Promo code applied automatically.

OPEN A NEW WHITE SOX CHECKING ACCOUNT AND GET A $300 BONUS WHEN YOU4:

OPEN A NEW WHITE SOX CHECKING ACCOUNT AND GET A $300 BONUS WHEN YOU4:

• Enroll in online banking & e-statements.

• Have $500+ in direct deposits each month of the Qualification Period.

Promo code applied automatically.

Promo code applied automatically.

Mastercard is a registered trademark, & the circles design is a trademark, of Mastercard International Incorporated. Chicago White Sox trademarks & copyrights proprietary to Chicago White Sox. Used with permission. Visit MLB.com.

1. ATM Fees. No Wintrust Financial Corporation (‘WTFC’) transaction charge at ATMs in the Allpoint, ATM Access (Town Bank customers only), MoneyPass, or Sum networks. Banks outside the network may impose ATM surcharges. Surcharge fees assessed by owners of ATMs outside the network will be reimbursed. Reimbursement excludes 1.10% International Service fee for certain foreign transactions conducted outside the continental U.S.

2. White Sox Checking Bonus Information. Offer valid for accounts opened 2/1/24 – 1/29/25. Offer not available to existing or closed checking account customers of WTFC & its subsidiaries or employees. Limit 1 bonus payment per customer, regardless of number of accounts opened; may only be received from 1 WTFC location. Offer combinable with any WTFC savings offer. Bonus payment subject to IRS 1099-INT reporting & may be considered income for tax purposes.

3. Digital Banking Services. Online or mobile banking required to access Zelle®. Internet/mobile connectivity required. Mobile banking required to access remote deposit capture. Deposits made through mobile banking or remote deposit capture are subject to deposit limits & funds are typically available by next business day. Deposit limits may change at any time. Third-party message/data rates & other restrictions may apply. For more information go to wintrust.com/agreement-and-disclosure.

4. White Sox Checking Bonus Qualifications. (i) Open new White Sox Checking account; (ii) mention offer during in-branch account opening, visit URL provided, or enter Esox300 when applying online; (iii) have direct deposits totaling at least $500 per month made to the new account for 2 consecutive calendar months after the calendar month the new account was opened (‘Qualification Period’); & (iv) enroll in online banking & e-statements within the Qualification Period. Direct deposit is a payment made by a government agency, employer, or other third-party organization via electronic deposit, but does not include teller/ATM/mobile or remote deposits, wire transfers, digital banking/telephone transfers between accounts at WTFC, external transfers from accounts at other financial institutions, peer-to-peer network payments like Zelle® or Venmo, or debit card transfers & deposits. New account must be open & have a balance greater than $0 to receive bonus payment. Balance determined as of end of each business day as funds currently in the account including deposits & withdrawals made in the business day. For eligible customers, bonus is deposited into the new account within 30 calendar days after the Qualification Period. A listing of WTFC locations can be found here: wintrust.com/locations.